Tato webová stránka používá cookies

Pro lepší zážitek při procházení našich webových stránek používáme cookies. Kliknutím na Povolit vše souhlasíte s jejich používáním. Další informace najdete pod tlačítkem Upravit.

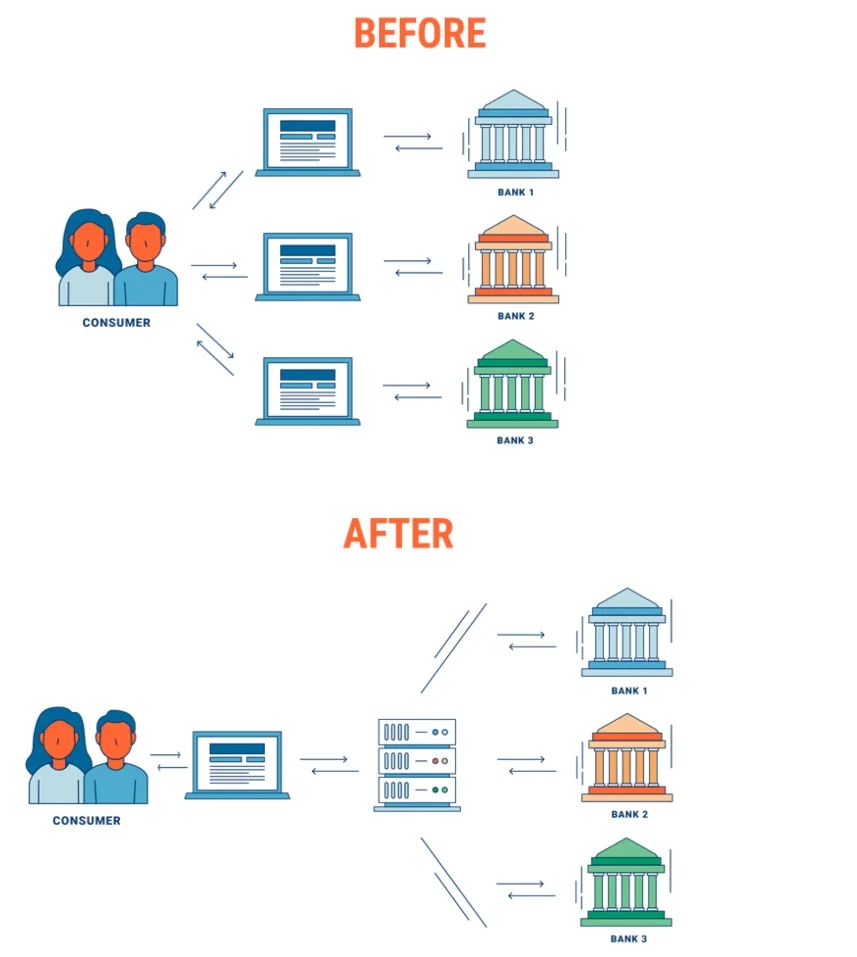

For Twisto, we implemented an API solution based on the European Parliament's PSD2 directive. This directive must be complied with by all banking entities since 2018 when the directive came into force. The directive addresses the increased flexibility of the banking sector using third-party access during the contact between the bank and its customer.

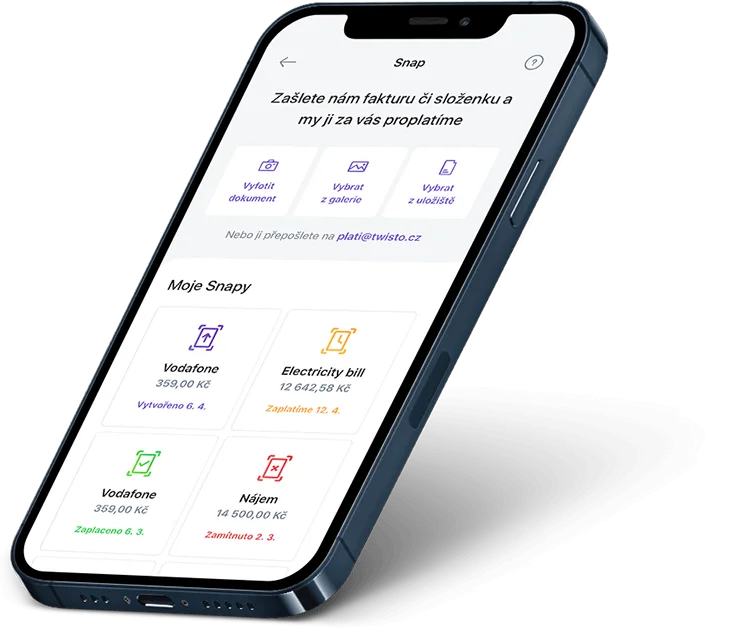

They were the first to introduce "buy now, pay later" payments in the Czech Republic. Twisto is an online payment service with which you can buy goods immediately and pay for them in 14 days. In 2018, the company expanded into Poland and currently has over one million clients.

PSD2 (Payment services directive 2) has revolutionized the world of online banking with these key points.

At the same time, PSD2 requires banks to make their customers' data available to third parties via an API (Application Programming Interface). This obligation means that banks that choose to be only in basic compliance with the requirements of PSD2 become passive intermediaries in providing these new services.

Do not hesitate and contact us.